Since inception, we have through our co-investment service led investments in 24 funding rounds, in a total of 17 companies. The first co-investment, in LNGTainer, was done in Sep-2014, and the latest, in Navigine (follow-on), in Jul-2017. In order to track our co-investment performance, we are now introducing the Innovestor Co-Investment Return Indicator, or iCORE-indicator.

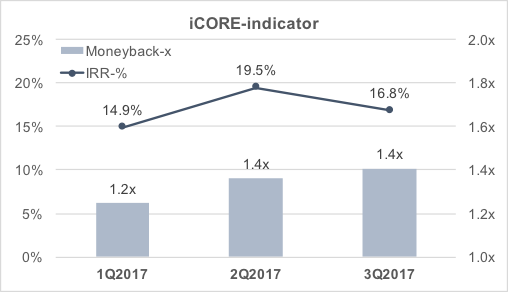

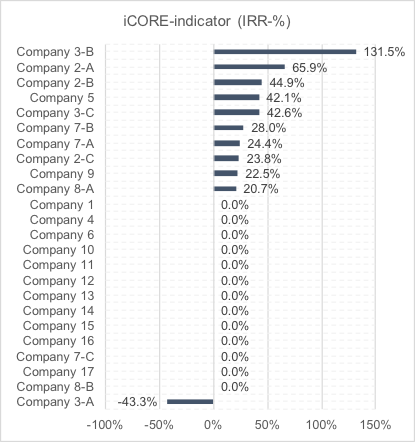

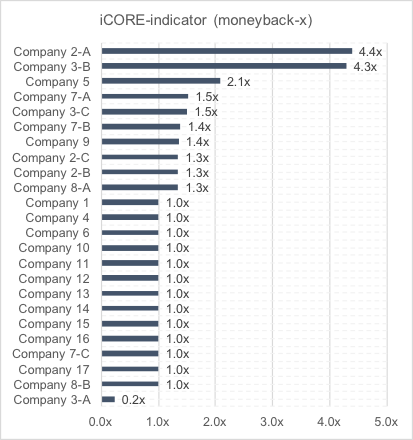

With the iCORE-indicator, we basically seek to answer the following question: if an investor would have invested an equal EUR amount, into all our funding rounds, what would the return be? Return is presented as IRR (annualized percentage) and money-back multiple (x investment amount). We have analyzed the results for 2017.

The iCORE-indicator is sensitive to the methodology used for estimating current fair value of investments. Therefore, our approach is cautious. We value all investments at cost, unless there has been a new funding round, secondary market transaction, M&A, IPO or liquidation. In short, we do not take an active view, but rely on market validation.

As of 3Q2017, the iCORE-indicator is IRR 16.8% / money-back 1.4x. The average holding period for the investments is 17 months. Of 17 companies, 11 are valued at cost, and 6 at a premium based on principles outlined above. Summary presented below.

Author: Wilhelm Lindholm, Partner, Chief Investment Officer at Innovestor Group