Blog: What returns to expect as an angel investor?

People considering direct investments into early-stage growth companies often wonder what returns such investments could yield. As an asset class, seed investments have particular characteristics. On one hand, it is a high-risk instrument due to the uncertainties related to future cash flows and its liquid and long-term nature. On the other hand, it offers exceptional growth and value creation potential. The lower liquidity leads to potential mispricing and presents arbitrage opportunities. It also provides diversification to help sustain market volatility.

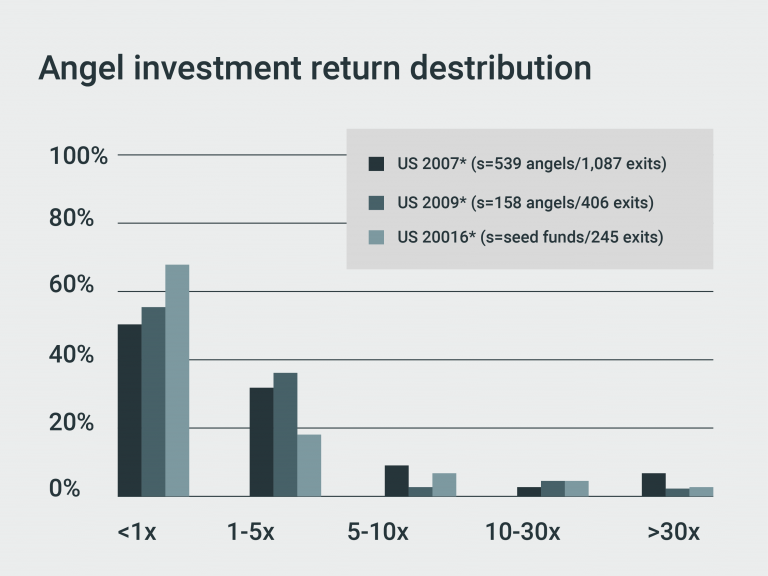

American academic Robert E. Wiltbank specializes in research related to angel investment returns. During the last ten years, he has published three studies* on the topic, and found the following average angel investment returns:

- Return multiple: 2-2.6x

- Holding period: 5-4.5 years

- IRR equity: 22-27%

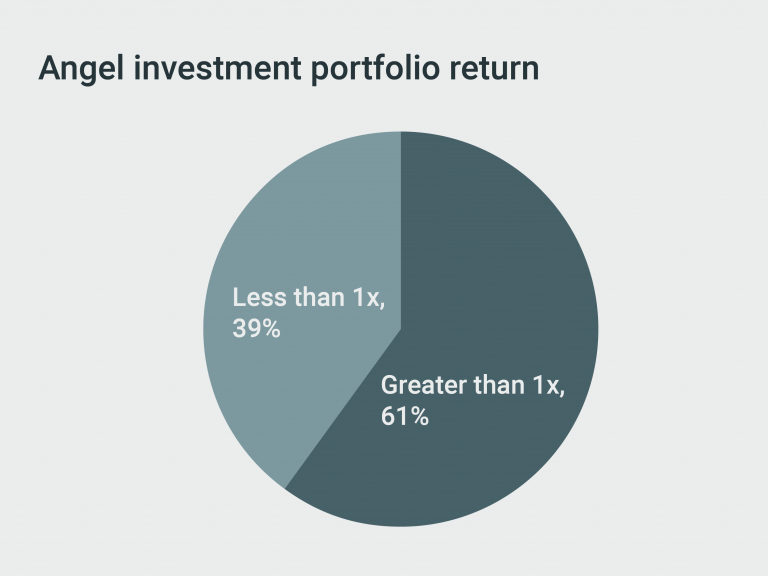

The studies also contain some noteworthy observations. First, angel investing (like formal VC) is a homerun game, where many investments result in losses but the occurrence of large homeruns are the key drivers of return rates. Second, distribution of returns is highly skewed: for a single investment, the median return is a loss (exit < 1x multiple), while the mean return is a 2.5x multiple. Third, and importantly, while over 50% of single investment results in returns of less than 1x multiple, that number is reduced to less than 40% on an overall level for those angel investors who have multiple investments, implying that a portfolio approach significantly improves the prospect of overall positive multiples. Forth, hardly surprising, spending time on due diligence as well as having industry and entrepreneurial experience is significantly related to better outcomes.

The above presented average returns on angel investments are attractive, and in line with economic theory which suggests that investors should be compensated for the increased risks associated with the asset class. In short, investments in promising early-stage companies offers an excellent (and exciting!) supplement to the more traditional assets (deposits, bonds, equities, real estate) in an overall wealth portfolio.

US 2016 = Wiltbank & Brooks (Kaufmann Foundation) 05/2016: Tracking Angel Returns. UK 2009 = Wiltbank (BBAA & Nesta) 05/2009: Siding with the Angels. US 2007 = Wiltbank & Boeker (Kauffman Foundation) 11/2007: Returns to Angel Investors in Groups.